Table of Contents

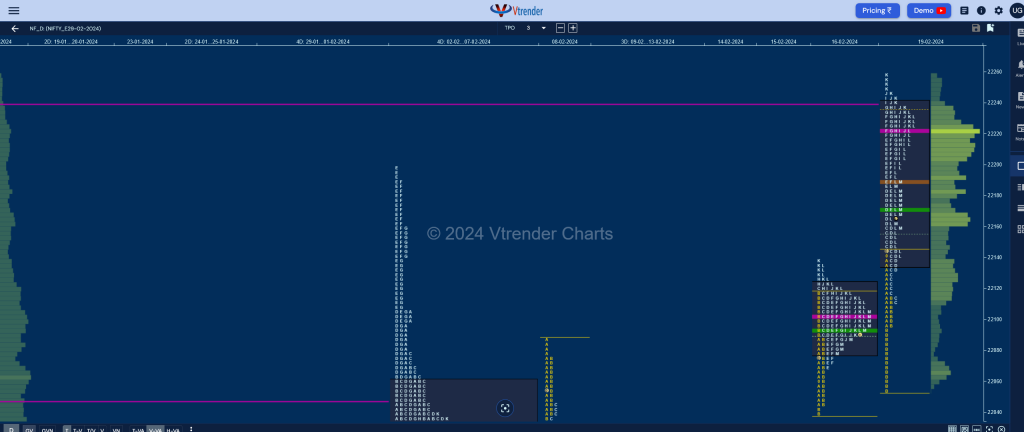

- Market Profile Analysis dated 20th February 2024 - Decode the markets ...

- Tendenze di Acquisto per il Natale 2024, analisi del GOLD PANEL BIG

- Netra January 2024 Market Analysis Report – 3 Key Takeaways! - Blog by ...

- TheStreet Pro

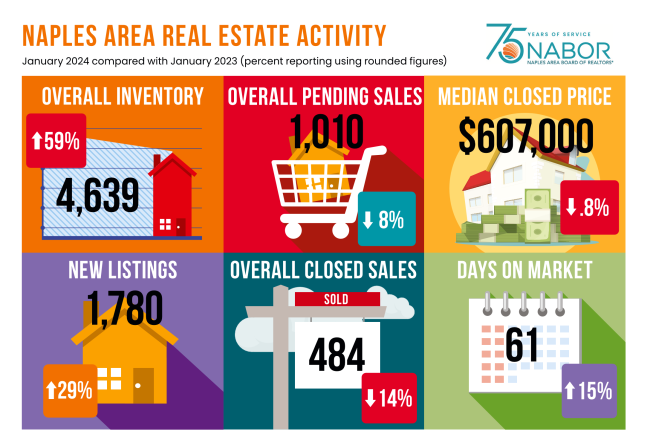

- January Market Report Shows Suitable Climate for Seasonal Sales | Roorda

- Proyeksi Pergerakan IHSG di Tahun Politik: Analisis dari Economic and ...

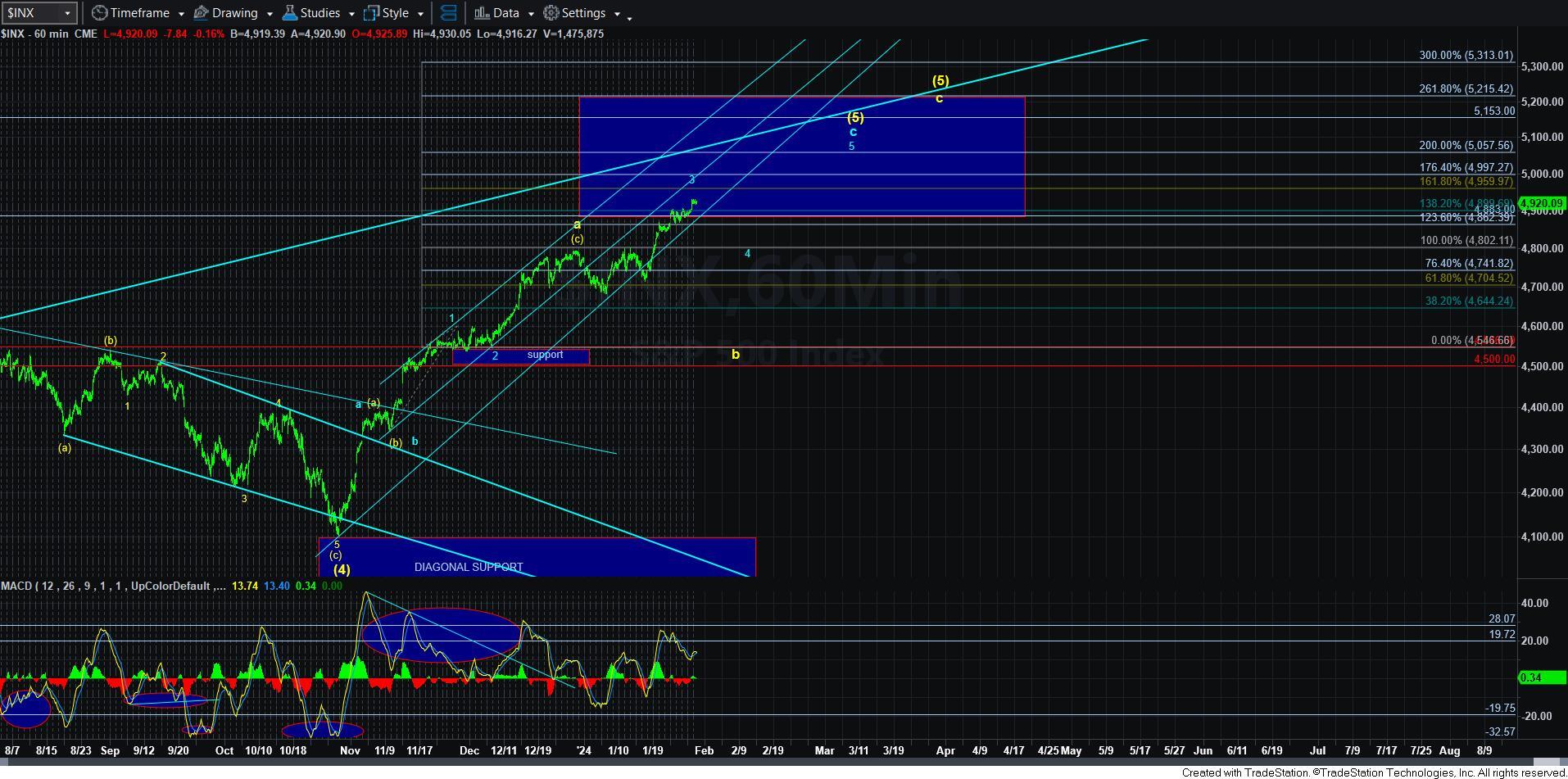

- Getting Closer - Market Analysis for Jan 30th, 2024 - ElliottWaveTrader

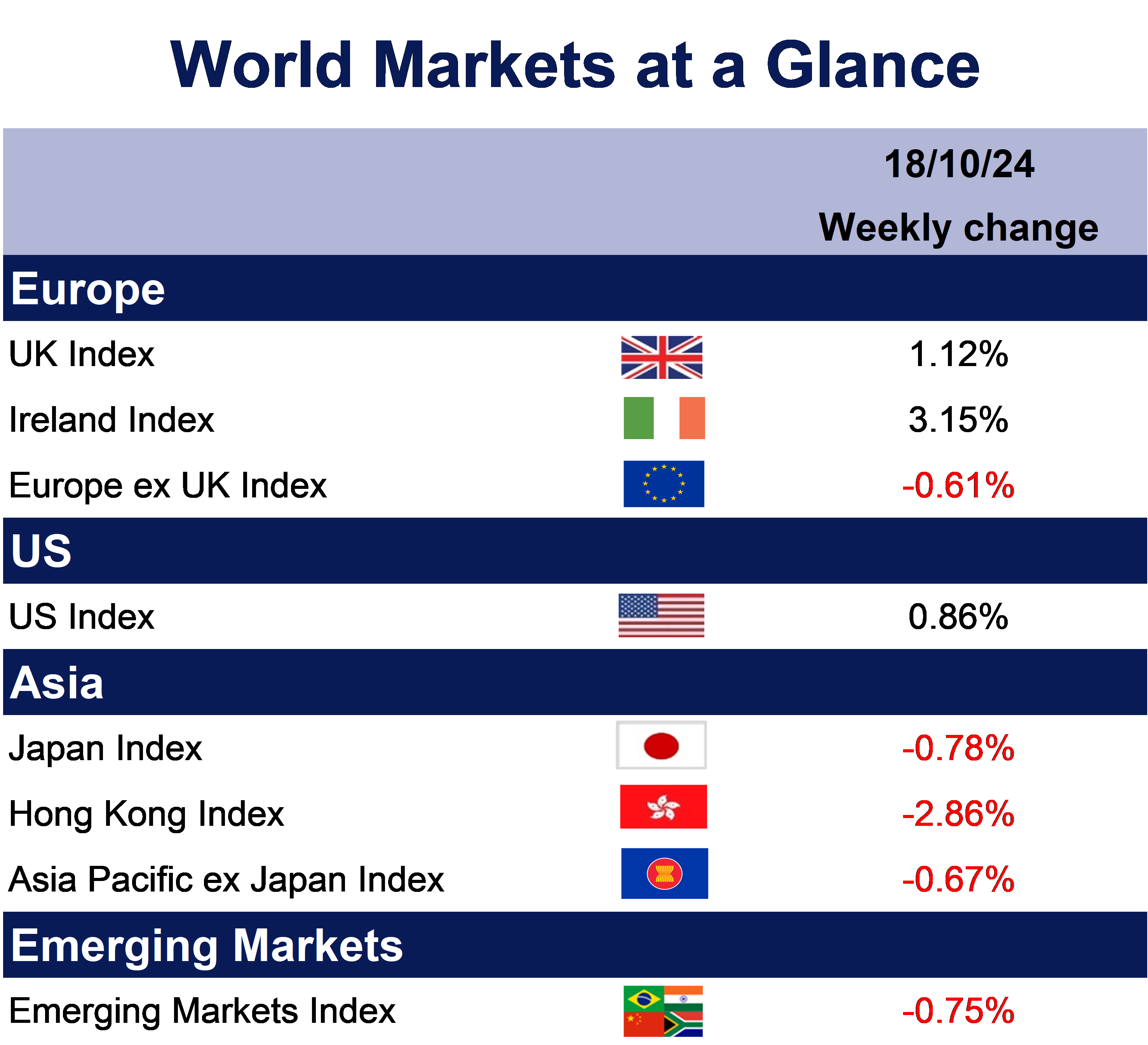

- Week ending 18th October 2024. - my wealth

- Could market volatility already be turning up in early 2024?

- พาส่อง 10 อันดับเทรนด์ ขายของออนไลน์ อะไรดี 2024

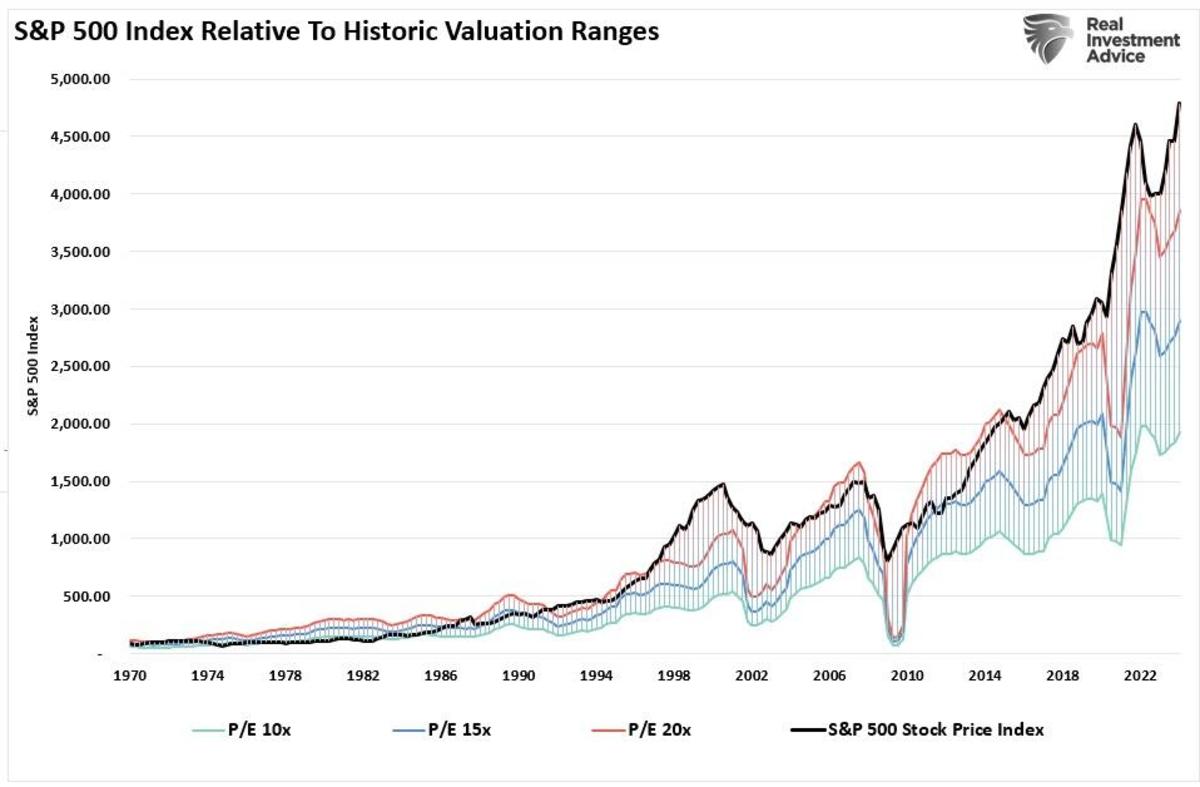

Economic Trends

Industry Insights

Investment Strategies

In light of the 2024 market snapshot, investors should consider the following strategies: Diversification: Spread investments across different asset classes, sectors, and geographies to minimize risk and maximize returns. Sustainable Investing: Invest in companies and industries that prioritize environmental, social, and governance (ESG) factors, as these are likely to experience long-term growth and stability. Emerging Markets: Consider investing in emerging markets, such as Asia and Latin America, which offer significant growth potential and diversification benefits. The 2024 market snapshot presents a complex and dynamic landscape, with both opportunities and challenges. By understanding the key trends, industries, and investment strategies, businesses, investors, and individuals can navigate the changing market and make informed decisions. As we move forward into 2024, it is essential to stay adaptable, innovative, and focused on long-term growth and sustainability. With the right approach, it is possible to thrive in this evolving market and capitalize on the opportunities that emerge.Keyword density: Market snapshot (1.2%), 2024 market outlook (0.8%), economic trends (0.6%), industry insights (0.6%), investment strategies (0.6%)

Meta description: Discover the key highlights and takeaways from the 2024 market snapshot, including economic trends, industry insights, and investment strategies. Navigate the changing landscape and make informed decisions.

Header tags: H1 (1), H2 (4)

Image suggestions: Infographics highlighting economic trends, industry growth, and investment strategies; images of renewable energy sources, technological advancements, and e-commerce platforms.