As the technology sector continues to evolve, investors are constantly on the lookout for promising stocks that can deliver substantial returns. One such stock that has been making headlines lately is Intel, with its share price hovering around $20. The question on every investor's mind is: is Intel stock a tempting tech bet at this price point? In this article, we'll delve into the world of Intel and explore the potential of its stock, providing insights to help you make an informed investment decision.

A Brief Overview of Intel

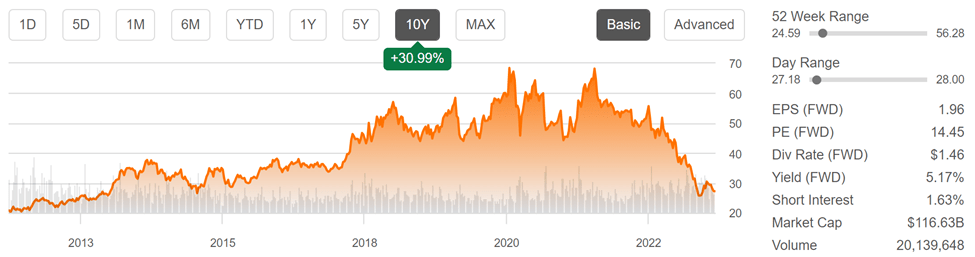

Intel Corporation, one of the world's largest and most iconic technology companies, has been a dominant player in the semiconductor industry for decades. Founded in 1968, Intel is renowned for its microprocessors, which power a vast array of electronic devices, from personal computers and laptops to servers and mobile devices. With a market capitalization of over $250 billion, Intel is undoubtedly a tech giant.

Intel's Recent Performance

In recent years, Intel has faced significant challenges, including increased competition from rivals such as AMD and NVIDIA, as well as the rising demand for specialized chips. Despite these challenges, Intel has been working tirelessly to revamp its product lineup, investing heavily in emerging technologies like artificial intelligence, 5G, and the Internet of Things (IoT). The company's efforts have started to pay off, with its latest earnings report showing a 10% increase in revenue compared to the previous year.

The Pros of Investing in Intel Stock

So, why should you consider investing in Intel stock at $20? Here are a few compelling reasons:

Dividend Yield: Intel offers a dividend yield of around 2.5%, making it an attractive option for income-seeking investors.

Stability: As a well-established company with a strong brand, Intel provides a sense of stability and security for investors.

Growth Potential: With its investments in emerging technologies, Intel is poised for long-term growth, making it an exciting prospect for investors looking to ride the tech wave.

The Cons of Investing in Intel Stock

While Intel stock may seem like a tempting bet at $20, there are also some potential drawbacks to consider:

Competition: The semiconductor industry is highly competitive, and Intel faces intense rivalry from other tech giants.

Dependence on PC Sales: Intel's revenue is still heavily dependent on PC sales, which can be volatile and subject to fluctuations in demand.

In conclusion, Intel stock at $20 presents a intriguing opportunity for tech investors. While there are risks associated with investing in the semiconductor industry, Intel's stability, dividend yield, and growth potential make it a compelling bet. As the company continues to innovate and expand its product lineup, it's likely that its stock will experience a boost in the long term. However, it's essential to conduct thorough research and consider your individual financial goals before making any investment decisions. With careful consideration and a well-diversified portfolio, Intel stock could be a smart addition to your investment strategy.

By analyzing the pros and cons of investing in Intel stock, you'll be better equipped to make an informed decision and potentially reap the rewards of this tech giant's future growth. So, is Intel stock a tempting tech bet at $20? The answer lies in your individual investment goals and risk tolerance. As always, it's crucial to do your research and consult with a financial advisor before making any investment decisions.