Table of Contents

- NYSE:UNH UnitedHealth stock price forecast: Buy Breakout, Target : 390 ...

- UNH Stock Forecast 2024: UnitedHealth Group Q2 Performance and Outlook

- Trade of the Day: UnitedHealth Stock Is Primed for a Counter-Trend ...

- 4 Top Stock Trades for Thursday: NFLX, F, UNH, QQQ | InvestorPlace

- UnitedHealth Group (UNH): High-Quality Dividend Stock - Dividend Power

- UNH Stock Price and Chart — NYSE:UNH — TradingView

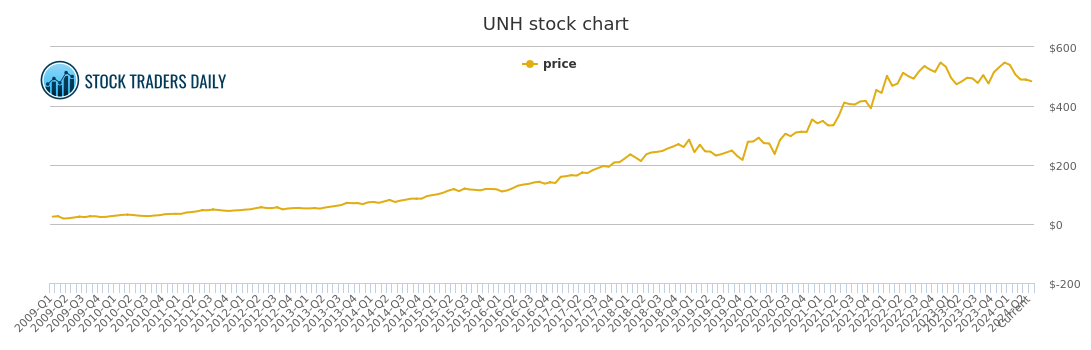

- UNITEDHEALTH GROUP . UNH STOCK CHART

- Why Did Option Value Decline After Stock Price Accelerated? A Real-Life ...

- UNH Stock Price and Chart — NYSE:UNH — TradingView

- logotipo de unh. letra unh. diseño del logotipo de la letra unh ...

Company Overview

Stock Performance

News and Updates

CNBC has been closely following the news and updates related to UnitedHealth Group Inc. Some of the recent news includes the company's announcement of its quarterly earnings, which exceeded analyst expectations. The company reported a net income of $4.3 billion, up 12% from the same period last year. Additionally, UnitedHealth Group Inc has been expanding its services, including the launch of a new virtual care platform, which aims to provide patients with convenient and accessible healthcare services.

Financials

UnitedHealth Group Inc's financials have been impressive, with the company reporting revenues of over $280 billion in 2022. The company's operating margin has been steadily increasing, with a margin of 7.3% in 2022, up from 6.8% in 2020. The company's strong financials have enabled it to invest in strategic acquisitions, expand its services, and return value to its shareholders through dividends and share buybacks. In conclusion, UnitedHealth Group Inc is a leader in the healthcare industry, with a strong track record of financial performance and a commitment to providing high-quality healthcare services to its customers. The company's stock price has been steadily increasing, driven by its strong financials, strategic acquisitions, and growing demand for healthcare services. As reported by CNBC, the company's news and updates have been positive, with the company announcing strong quarterly earnings and expanding its services. If you're an investor looking for a stable and growing stock, UnitedHealth Group Inc may be worth considering.For more information on UnitedHealth Group Inc's stock price, quote, and news, please visit CNBC.

Note: The information provided in this article is for general purposes only and should not be considered as investment advice. It's always recommended to consult with a financial advisor before making any investment decisions.